What Drives Stock Prices?

Published Wednesday, October 20, 2021 at: 8:58 AM EDT

The growth of the economy drives investment returns, and plain and simple, corporate profits—that is, earnings—drive stock prices. Without an understanding of what drives stock prices, investors are often fearful when stock prices plunge or, ironically, when they are breaking record highs. Here’s some help.

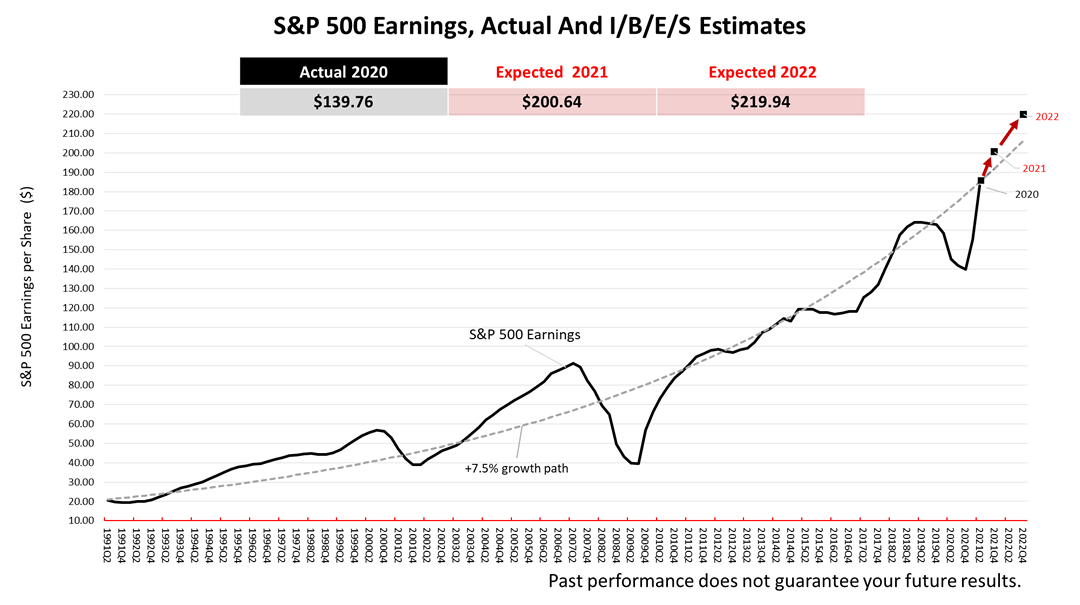

Perhaps the most direct way of connecting the dots between economics and investing is this chart illustrating that what drives stock prices is earnings.

The gray dotted line shows the 7.5% long-term earnings growth trend since 1991. In 2020, actual earnings of the S&P 500 companies were $139.76 per share. Expected earnings in 2021, according to Wall Street analysts’ estimates compiled by Institutional Brokers' Estimate System (IBES), are $200.64 per share and are expected to shoot up to $219.94 for 2022.

The red arrows literally connect the dots to make the forecast clear: The next 20 months’ corporate earnings are expected to rocket much higher.

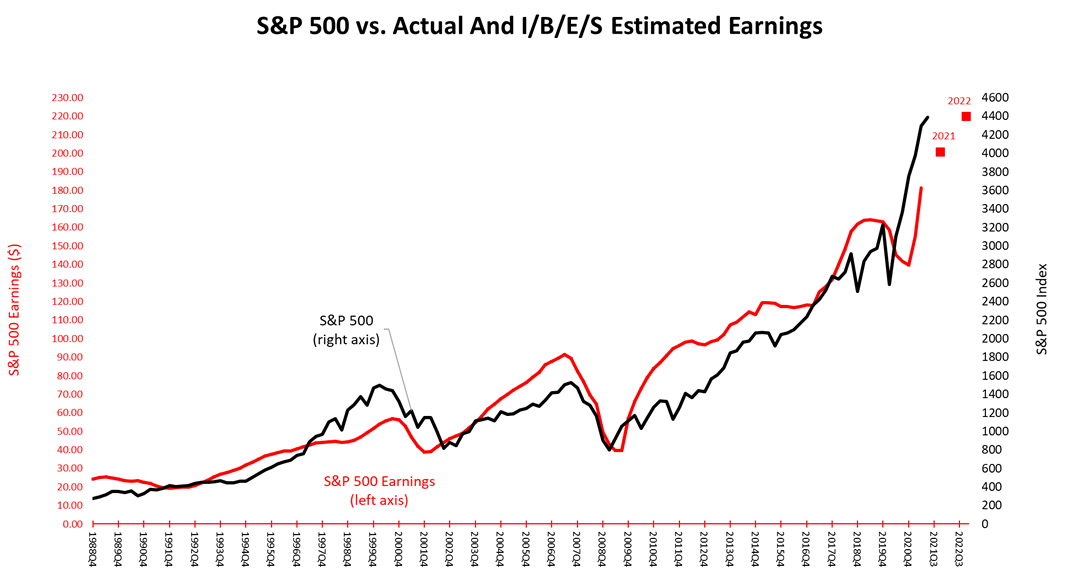

In this chart, to show how earnings drive stock prices, we added the S&P 500 Total Return index, in the black line to the earnings line in red. This shows the nearly perfect correlation between stock prices and earnings since 1989. The 2021 and 2022 earnings forecasts, in the red dots, have pulled the black line higher.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation, or advice of any kind, and it is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Tax advice always depends on your particular personal situation and preferences. You should consult the appropriate financial professional regarding your specific circumstances. The material represents an assessment of financial, economic and tax law at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete, and is not intended to be used as a primary basis for investment decisions. This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2021

2020

2019

2018

2017

2016

2015

READY TO TAKE THE FIRST STEP?

Schedule your no-charge, no-obligation Introductory Phone Call.