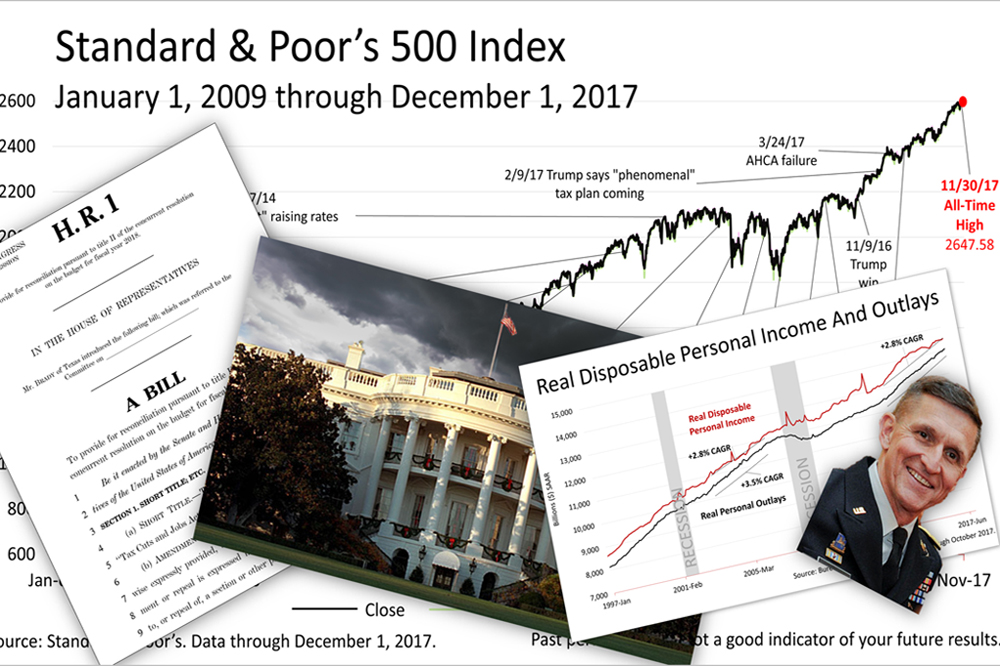

Despite The Washington Sideshow, Stocks Closed At A New All-Time High

Published Friday, May 26, 2017 at: 7:00 AM EDT

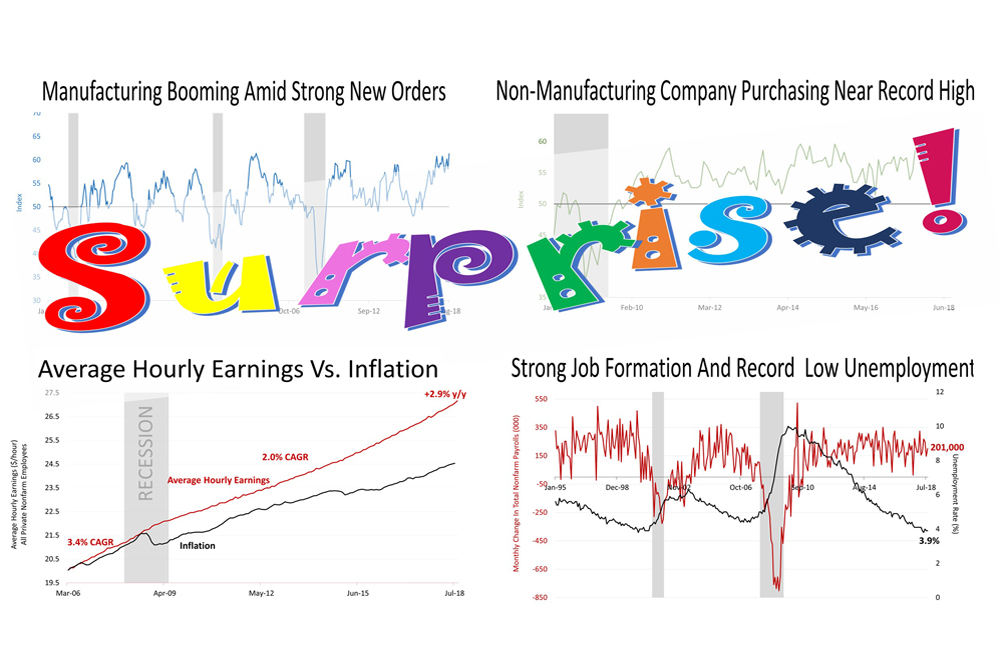

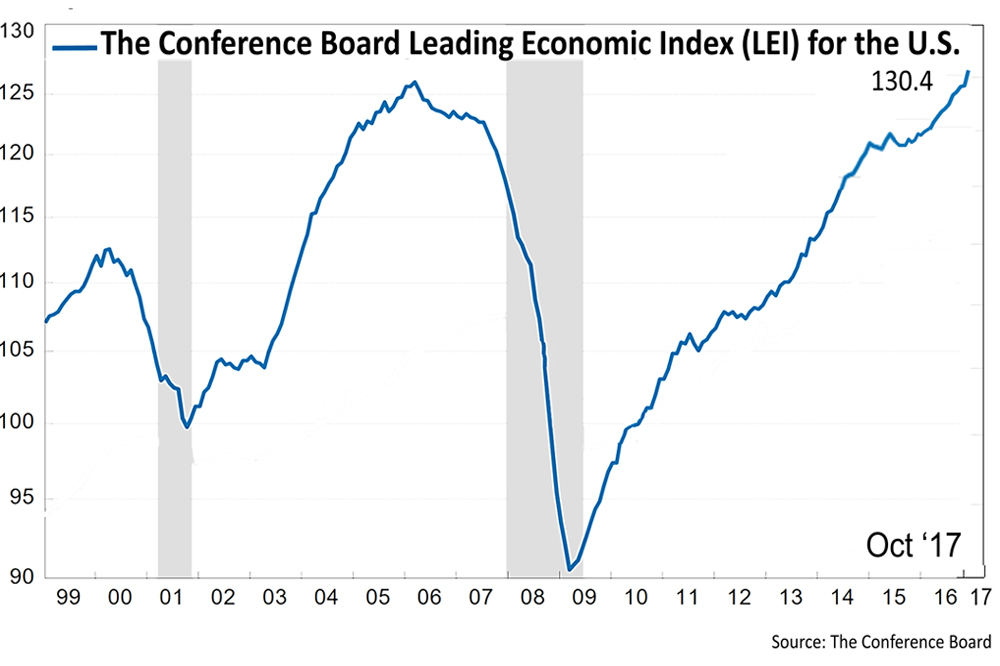

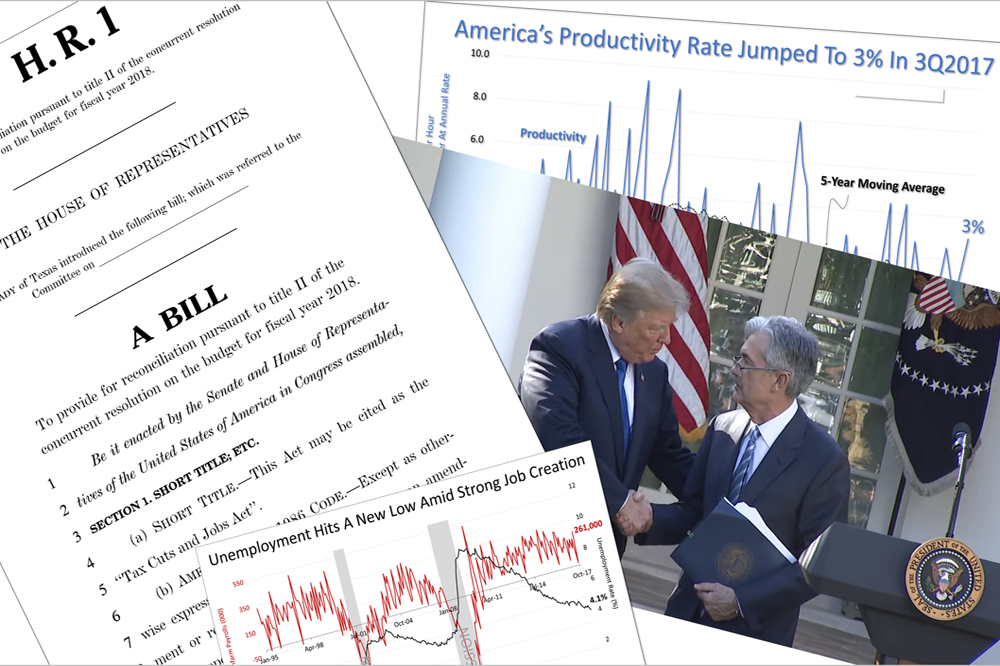

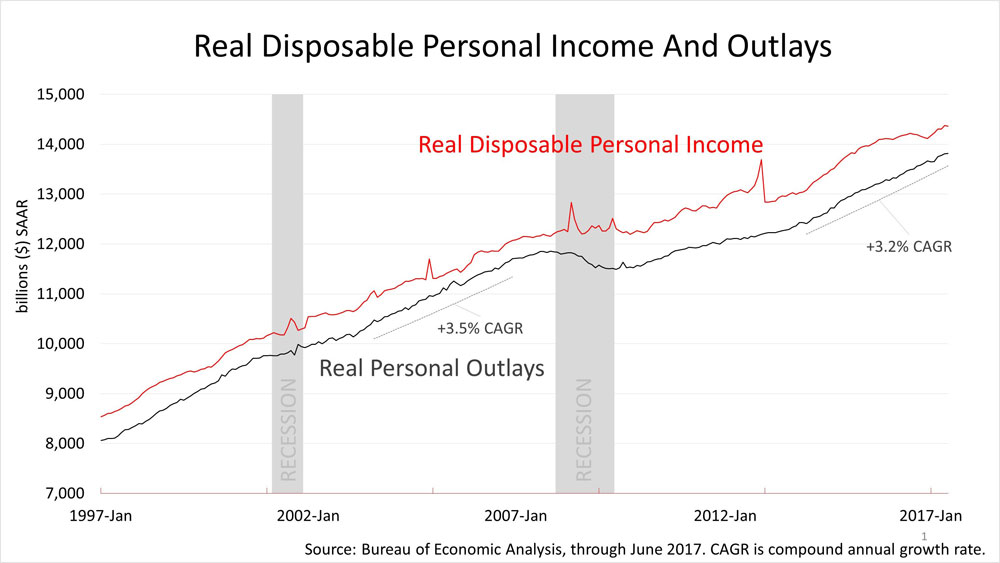

While the sideshow in Washington dominated the world stage again for yet another week, the economy deserves rave reviews.

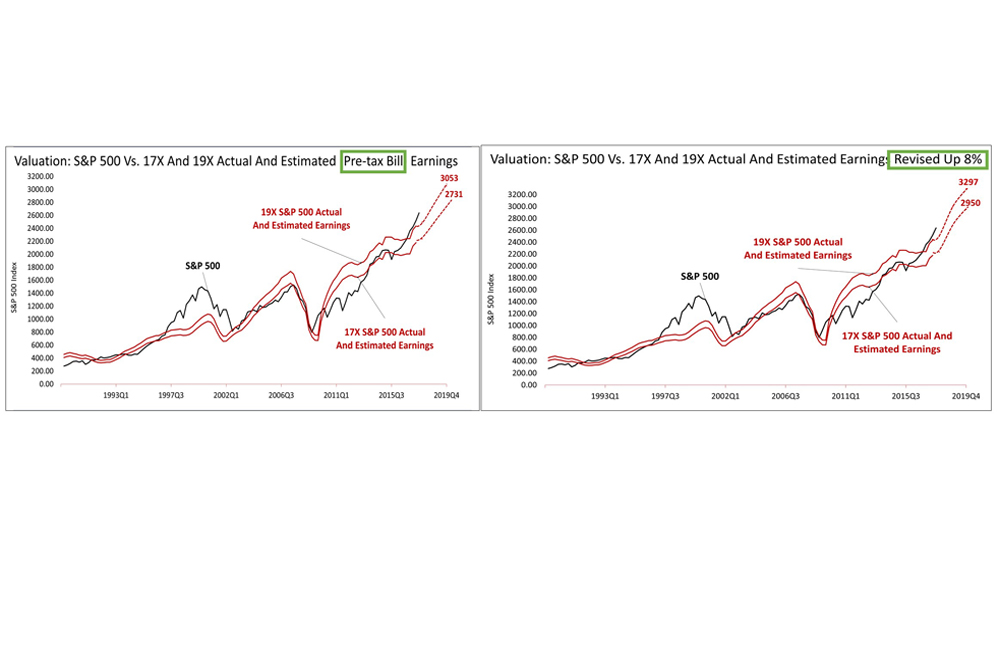

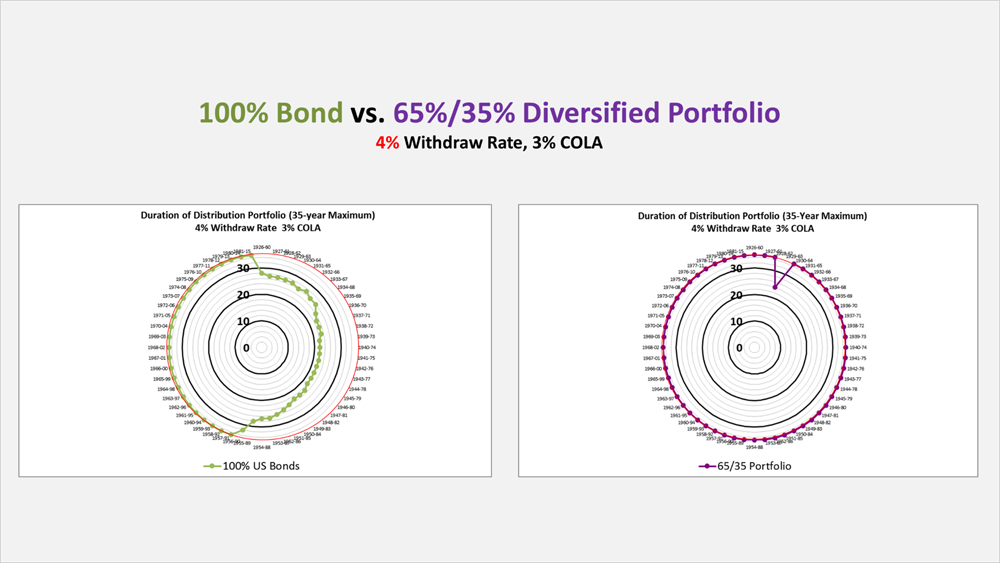

Earnings drive stock prices. Period. It's like financial gravity, and it's how the stock market works. Estimated operating earnings per share on the S&P 500, as of May 8, 2017, was $131.44 in 2017 and $147.10 in 2018. What's that mean?

Over time, the value of the Standard & Poor's 500, the black line, follows the action in the red line, which represents corporate earnings. At the end of the red line showing earnings historically are two dots representing earnings estimates for 2017 and 2018. Earnings - if they come in as estimated - set the path of the black line. To be clear, the black line, if analyst's estimates are correct, will be pulled higher toward the red dots.

While no one can predict the next up or down in the stock market, the earnings estimates puts stock prices - the black line - on a very positive trajectory.

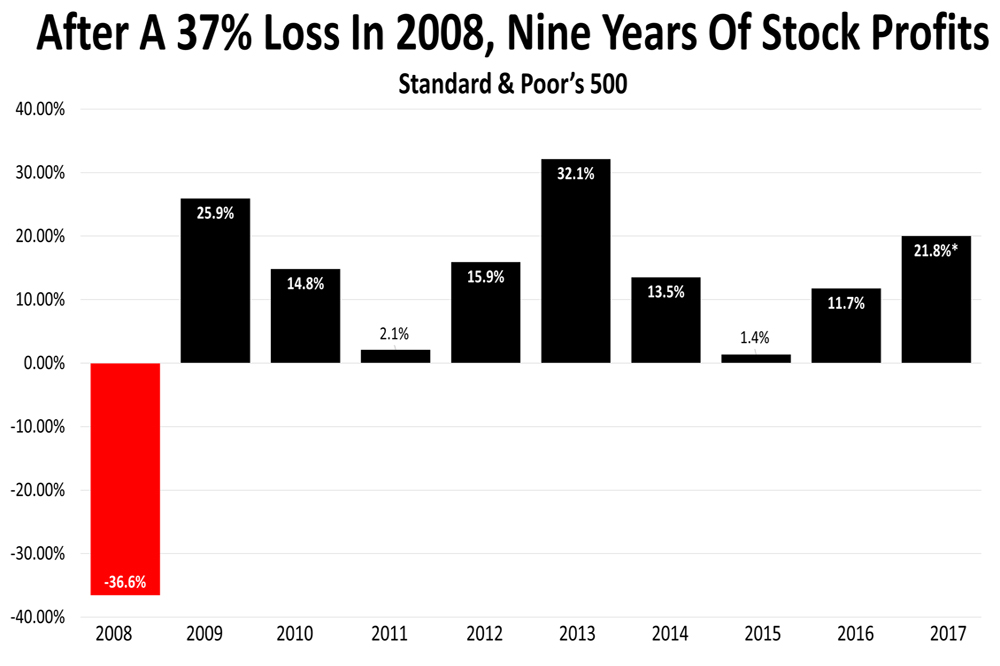

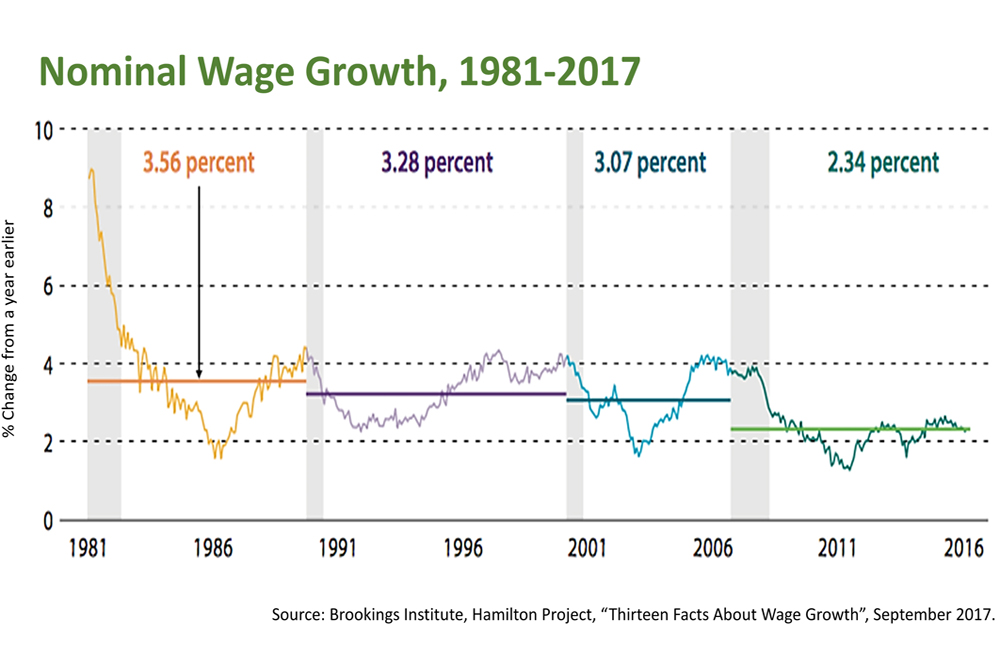

The 2014-15 collapse in oil prices and the 2014-15 surge in the U.S. dollar combined to cause a serious earnings recession. Lower oil prices and commodities crushed profits at U.S. companies in those sectors, hurting earnings for the overall S&P 500 index. However, since the bottom of the earnings recession in December 2015, earnings have snapped back, as shown in the steep 21% trendline. Standard & Poor's Inc., the independent rating agency, forecasts that earnings growth will substantially accelerate from the second quarter of 2017 through the end of 2018.

If Standard & Poor's forecasts are correct, we're in the early innings of an earnings recovery, with profits expected to soar 22% in 2017 over a year earlier, and by another 13% in 2018.

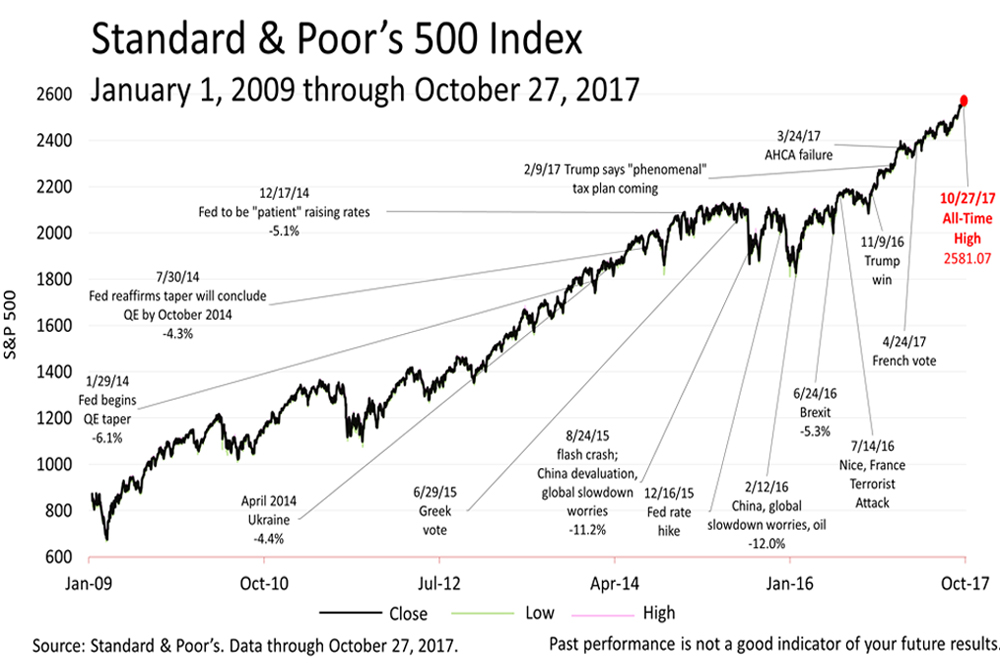

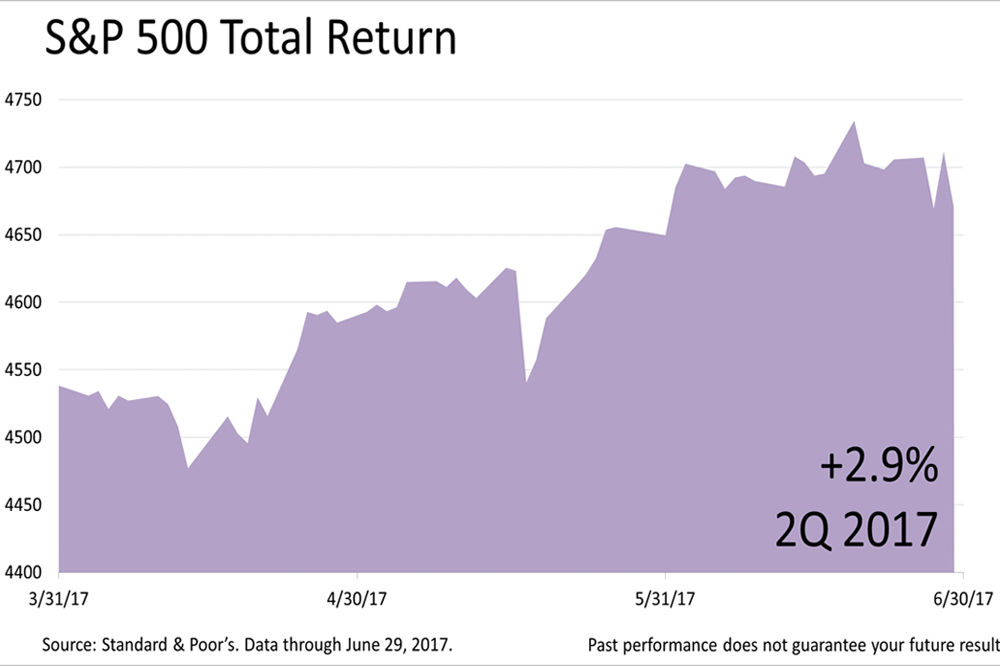

The earnings news drove the Standard & Poor's 500 index 1.4% higher for the week, and it closed Friday at 2415.82, a new all-time high.

While you may be infuriated by the circus in Washington, the U.S. economy has remained the greatest show on earth.

The political crisis in Washington has not stopped the march of the American economy's progress, demonstrating what makes America great.

On this Memorial Day, we are grateful to the members of the U.S. armed forces for their service and sacrifice, and wish you and your family a wonderful holiday weekend.

This article was written by a professional financial journalist for Advisor Products and is not intended as legal or investment advice.

2024

-

Stocks Closed At A Record High

Stocks Closed At A Record High

-

Federal Reserve Projects Strong Growth

Federal Reserve Projects Strong Growth

-

The Best People Were Wrong

The Best People Were Wrong

-

This Week’s Investment News In Six Charts

This Week’s Investment News In Six Charts

-

U.S. Investor Picture Of The Week

U.S. Investor Picture Of The Week

-

The Conference Board Backs Off Its Recession Forecast

The Conference Board Backs Off Its Recession Forecast

-

Softening Economic Data, Inflation Fears Dampen Stock Rally

Softening Economic Data, Inflation Fears Dampen Stock Rally

-

S&P 500 Closes Above 5000 For The First Time Ever

S&P 500 Closes Above 5000 For The First Time Ever

-

Why America Is The World’s Economic Leader

Why America Is The World’s Economic Leader

-

Investment News For The Week Ended Friday, January 26

Investment News For The Week Ended Friday, January 26

-

Why Stocks Broke The All-Time Record High

Why Stocks Broke The All-Time Record High

-

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

A Strategic Update, With Stocks Near All-Time High And Crises Unfolding

2023

2022

2021

2020

2019

2018

2017

2016

2015

READY TO TAKE THE FIRST STEP?

Schedule your no-charge, no-obligation Introductory Phone Call.